Stock market investing can yield high financial rewards. However, unless you understand how to invest properly, the markets can also take all of your money. The following article will provide you with great advice that can help you make big returns on your stock market investments.

The concept of keeping things simple works in numerous realms, including the stock market. Trading, making predictions or examining data points should all be kept simple.

If you are seeking ways to maximize your investment potential, it is important that you set long-term goals and have a plan. You’ll also be a lot more successful by having realistic expectations as opposed to trying to predict unpredictable things. Plan to keep your stocks as long as it takes for them to be profitable.

Anytime you choose to make a stock investment, keep your outlay to less than ten percent of available funds. This way if the stock does go into rapid decline at a later date, the amount of risk that you have been exposed gets greatly reduced.

Regard your stocks as if you own a piece of a company. Have the patience to research companies and look over financial statements in order to better understand the weaknesses and strengths of each company’s stocks. You will need time to decide whether or not to invest in certain stocks.

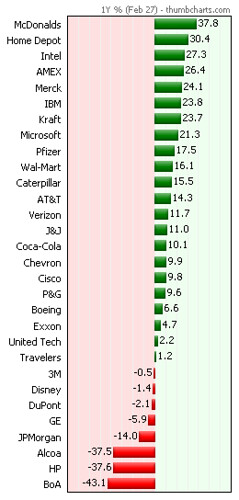

An important part of investing is re-evaluating your stock portfolio periodically, such as every quarter. Why? Because the economy, the stock market and investor preferences are continually evolving. Some sectors may start to outperform other sectors, and some companies will do better or worse than others. It may be wise to invest in some financial instruments than others, depending on the time period. It is of critical importance that you keep an eye on your portfolio and adjust to changes, as necessary.

Building a detailed, long-term investment plan and setting it down in writing is an important step to take if you want to maximize your stock portfolio’s performance. Be sure to include your specific intentions on when you will buy and when you will sell stocks. This should include clearly defined investment budgets. This practice will ensure that your decisions are based more on logic than on emotions.

There is a lot of stock advice out there that you need to outright avoid! Anything that’s unsolicited or in the too-good-to-be-true category should be ignored. You should listen to your advisor and find sources of information you can trust besides listening to successful traders. Do not pay attention to what others have to say. There really is no better advice to follow than what your own research indicates, and most unsolicited advice is being given only because they profit from it in some way.

Penny Stocks

Don’t put all your faith in penny stocks if you’re hoping to hit it big in the market. Although they pose a much lower risk, penny stocks will not give you the growth and interest rates of blue-chip stocks, so this is something to think about. Decide on a few large companies to form your base and then add stocks with the potential for strong growth. These companies have a track record for growth, so their stock is likely to perform well and consistently.

Don’t focus so intently on stocks that you miss other opportunities to make profitable investments. You can find many other promising investments, such as real estate, art, or mutual funds. Think about all your options and diversify your investments as much as possible, if you can afford to.

Develop your own stock investment plan and choose the strategies that work best for your overall goal. You might be looking for companies with consistently high-profit margins or alternatively ones that have a ton of available cash. Everybody has a different technique for investing, and it’s just a matter of figuring out which one works the best for you.

As this article stated previously, you can make a good income by investing in stocks. When you know exactly what to do, the amount of money you can make is limitless. The advice you have learned here can help you make the most of your investments.